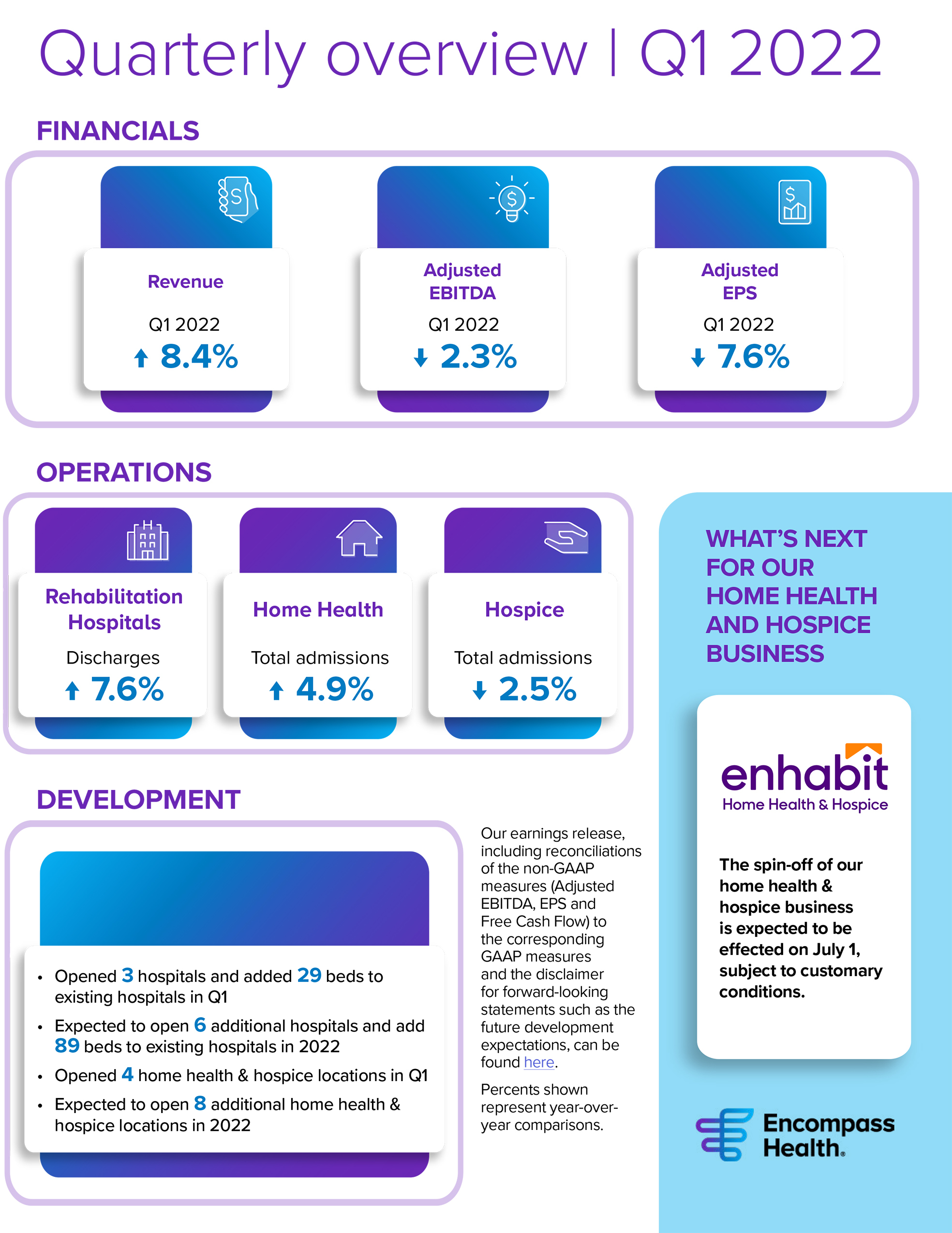

On April 27, we released our Q1 2022 earnings report. The results provide further evidence of the growing demand for the services we provide, as inpatient rehabilitation discharges increased 7.6% and home health admissions grew 4.9%. The 2022 guidance we provided when we last released earnings in February has not changed.

Despite impacts of the Omicron surge and ongoing staffing challenges, the dedication of our team members allowed us to continue to make significant operational and strategic progress. On a consolidated basis, for Q1 we generated 8.4% revenue growth. This revenue growth was offset by higher staffing costs in the quarter, resulting in a 2.3% decline in Adjusted EBITDA. We remain confident in the future prospects of our businesses and continue to enhance the positioning of each to capitalize on the growth opportunities ahead.

Growing Demand for Services

In the IRF segment, the strong discharge growth combined with a 2.2% increase in revenue per discharge drove 10.4% revenue growth. Average daily census increased to a new high of 7,330. Our home health business also generated solid admissions growth. Total admissions grew 4.9% in Q1, exceeding our prior historical high point achieved in Q1 2020. Hospice admissions declined, driven primarily by capacity constraints at larger branches with historically high average daily censuses.

Continued COVID-19 Challenges

Continued strong demand for our inpatient rehabilitation services in a tight labor market for skilled clinicians necessitated an increase in utilization of agency staffing and sign-on and shift bonuses on a year-over-year basis. We believe the utilization and rate of agency staffing peaked in March, and we expect gradual improvement through the second quarter.

On the home health and hospice staffing front, hiring started slowly in the quarter due to the Omicron surge but accelerated as the quarter progressed. We expect to continue to see positive trends in nursing hires as a result of our retention and recruitment strategies. Based predominantly on required staff quarantines in the first half of the quarter, we estimate that we lost 2,150 home health admissions.

CMS recently issued proposed rules that would update Medicare payment policies and rates for IRF and hospice providers. While the proposed rate updates are directionally positive, they do not adequately compensate for the elevated staffing costs. We are hopeful that the final rules, expected to be released in late July or early August, will provide greater relief. We expect CMS to release the proposed rule for home health in June or July.

Enhabit Home Health & Hospice Spinoff

The spinoff of our home health and hospice business into an independent, publicly traded company under the new name, Enhabit Home Health and Hospice, is expected to be effected on July 1, subject to customary conditions. We believe the spinoff will provide a number of significant benefits, including enhanced management focus, separate capital structures and allocation of financial resources, better alignment of management incentives and the creation of independent equity currencies. We intend to provide 2022 guidance for Encompass Health and Enhabit on a separated basis in the first half of June.

Maximizing Our Growth Strategy

Given the strong demand for our services, we have continued our growth strategy. We opened three de novo IRFs in first quarter and added 29 beds to existing hospitals. We anticipate opening an additional six de novo IRFs and adding an additional 89 beds to existing hospitals in 2022. We added four home health and hospice locations in the quarter, two of these via acquisition, and anticipate an additional eight de novo openings in 2022.

The content of this site is for informational purposes only and should not be taken as professional medical advice. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding any medical conditions or treatments.