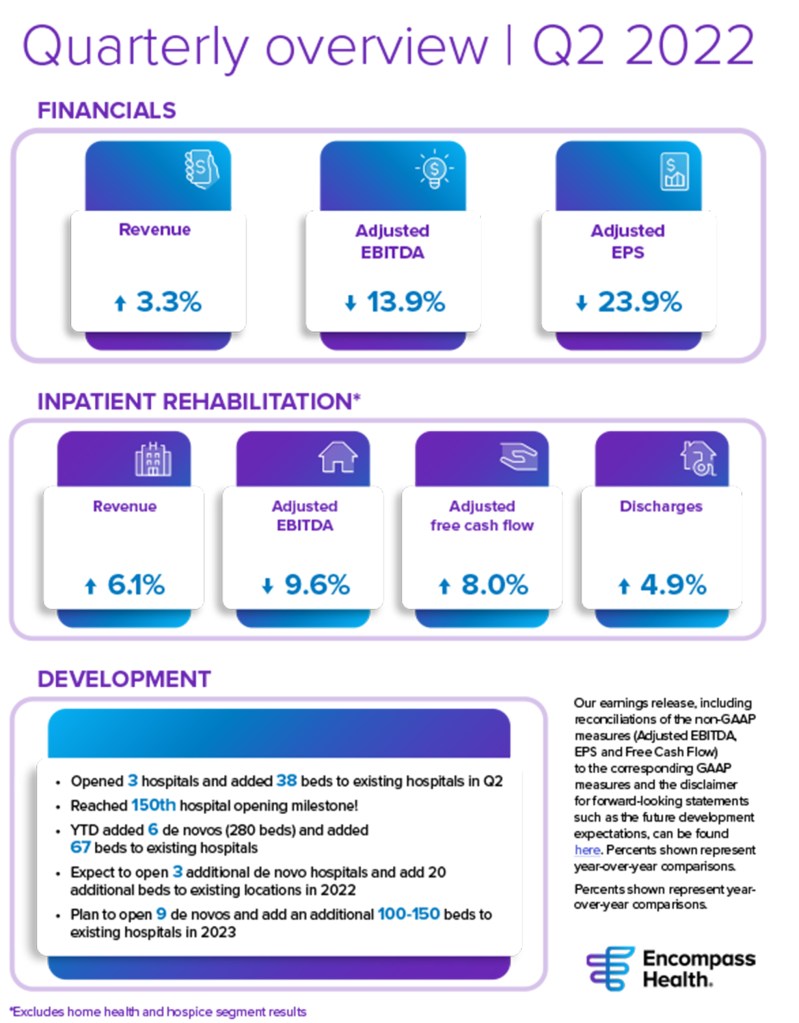

Encompass Health released its Q2 2022 earnings report on Aug. 1. As the spinoff of our home health and hospice business as an independent, publicly traded company was completed on July 1, our report’s comments are limited to Encompass Health’s inpatient rehabilitation business.

Continued Growth to Meet Rising Demand

Demand for inpatient rehabilitation services continues to grow. Discharges increased 4.9% (1.6% on a same-store basis) in Q2 on top of an 18.7% discharge growth (16.9% on a same-store basis) in Q2 2021, resulting in an impressive two-year compound annual growth rate. Our robust de novo and bed addition strategies are increasing availability of our services to meet this growing demand. Our commitment of substantial capital to these capacity expansions underscores our confidence in the future prospects of the inpatient rehabilitation business.

We opened three de novo hospitals in Q2 for a total of six year-to-date. We will open three more in the second half of 2022, bringing the total to nine de novo hospital openings for the year. We expect a similar number of de novo hospital openings in 2023. We added 38 beds to existing hospitals in the quarter, raising the year-to-date total to 67. We expect to add a total of approximately 100 beds to existing hospitals in 2022 and an additional 100 to 150 beds in 2023.

Positive Momentum in Staffing

Continued staffing challenges once again required the increased use of agency staffing and sign-on and shift bonuses in Q2. However, we saw an improvement in reducing contract labor costs. Consistent with our Q1 comments, we chose to redeploy a portion of the contract labor savings into sign-on and shift bonuses for our full-time employees.

We have responded to the challenging labor market conditions in a number of ways, including adding substantial resources to our talent acquisition team. We have built a centralized recruitment function now comprising more than 60 professionals. This strategy is gaining headway, as we had 276 new RN hires during the first half of 2022 compared to 117 in the same period last year.

For the second half of 2022, we expect sign-on and shift bonuses to remain elevated as we continue to hire more RNs and use existing staff to fill in gaps. This will facilitate a decrease in our utilization of contract labor.

CMS Final Rule

CMS issued the 2023 Final IRF Rule, with a net market basket update of 3.9%. We estimate that taken as a whole, the final rule will result in a 4% increase for our Medicare payments beginning in October. As a reminder, this increase does not include the impact of sequestration. While the rate update is positive relative to current reimbursement rates, it does not adequately compensate for our elevated operating costs.

Quarterly Dividend and Guidance

On July 20, our board of directors declared a quarterly dividend of $0.15 per share to be paid in October. The decline from our recent historical rate is in response to the completion of the Enhabit spinoff and reflects our continued commitment to a robust de novo hospital strategy.

The guidance we issued on June 7 for inpatient rehabilitation revenue, adjusted EBITDA and adjusted EPS has not changed.</p>

The content of this site is for informational purposes only and should not be taken as professional medical advice. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding any medical conditions or treatments.