The second quarter of 2021 is another reminder of the resiliency and sustainability of our business model. We had strong revenue growth in both our business segments, and as always, we have our employees and their dedication and expertise to thank for that.

Our clinical teams remain focused on the patient experience. It’s their commitment to our patients that truly drive the results of our business.

We released those results from the second quarter of 2021 on July 27. Here’s what you need to know:

Full-year 2021 guidance increasing

Business momentum accelerated in the second quarter this year. As a result, we raised our full-year 2021 guidance for the second time this year.

In our inpatient rehabilitation business, revenue increased 21.5%, discharges were up 18.7% and Adjusted EBITDA increased 40.9%.In our home health and hospice business, revenue increased 14.6%, total starts of care were up 10.9% and Adjusted EBITDA increased 311.3%.

As we look ahead to the remainder of this year, our 2021 guidance includes:

- Consolidated net operating revenues of $5.1 billion to $5.25 billion

- Consolidated Adjusted EBITDA of $1.05 billion to $1.07 billion

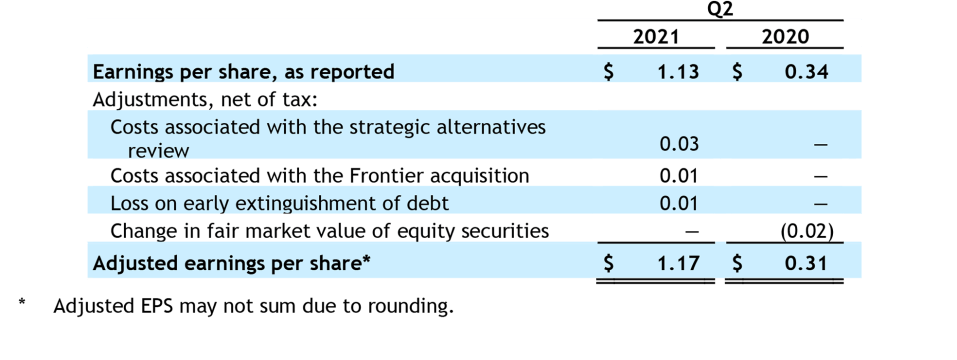

- Adjusted earnings per share of $4.32 to $4.47.

Enhanced clinical programs, protocols

As the nation’s leader in rehabilitative care, we continue to look for innovative ways to improve the patient experience and ultimately outcomes.

In addition to our existing readmission models, we began piloting a new predictive model in May. This one aims to reduce falls in our rehabilitation hospitals. Falls are a leading cause of hospital readmissions, which increase the cost of care and also set a patient back in their recovery.

In addition to using our data to improve outcomes and decrease the overall cost of care, we’re also continuing our sponsorship of the American Heart Association/American Stroke Association’s Together to End Stroke. A primary focus of this campaign, which is also an essential part of Encompass Health’s longstanding mission, is to transition more patients back to their communities with greater function and to develop evidence-based tools to inspire hope in the stroke community and reduce stroke mortality.

In 2020, we treated more than 34,000 stroke patients. That number is expected to grow to over 36,000 this year.

Growing our national footprint

During the second quarter, we added 41 beds to existing hospitals and opened two new hospitals—one in North Tampa, Florida, and the other in Cumming, Georgia. So far, we’ve opened three hospitals this year and expect to open five more in the back half of the year. We expect to open 12 new hospitals in 2022 and already have nine new hospitals slated to open in 2023.

Our teams are also focusing on the integration of the assets of Frontier Home Health and Hospice, which added nine home health and 11 hospice locations to our portfolio in June.

Home health and hospice strategic review update

In December 2020, we announced we would be conducting a strategic alternatives review of our home health and hospice segment. Based on that analysis so far, our board of directors believes a full or partial separation of our home health and hospice business will enhance the long-term success and value of the business. The final form is still to be determined, as we continue to pursue a separation transaction by either public or private means.

Having said that, I want to express my excitement about the appointments of Barb Jacobsmeyer as CEO and Crissy Carlisle as CFO of our home health and hospice business. I have worked closely with Barb and Crissy for many years and know they will do an excellent job.

Visit our investor relations site for more details on our Q2 earnings.

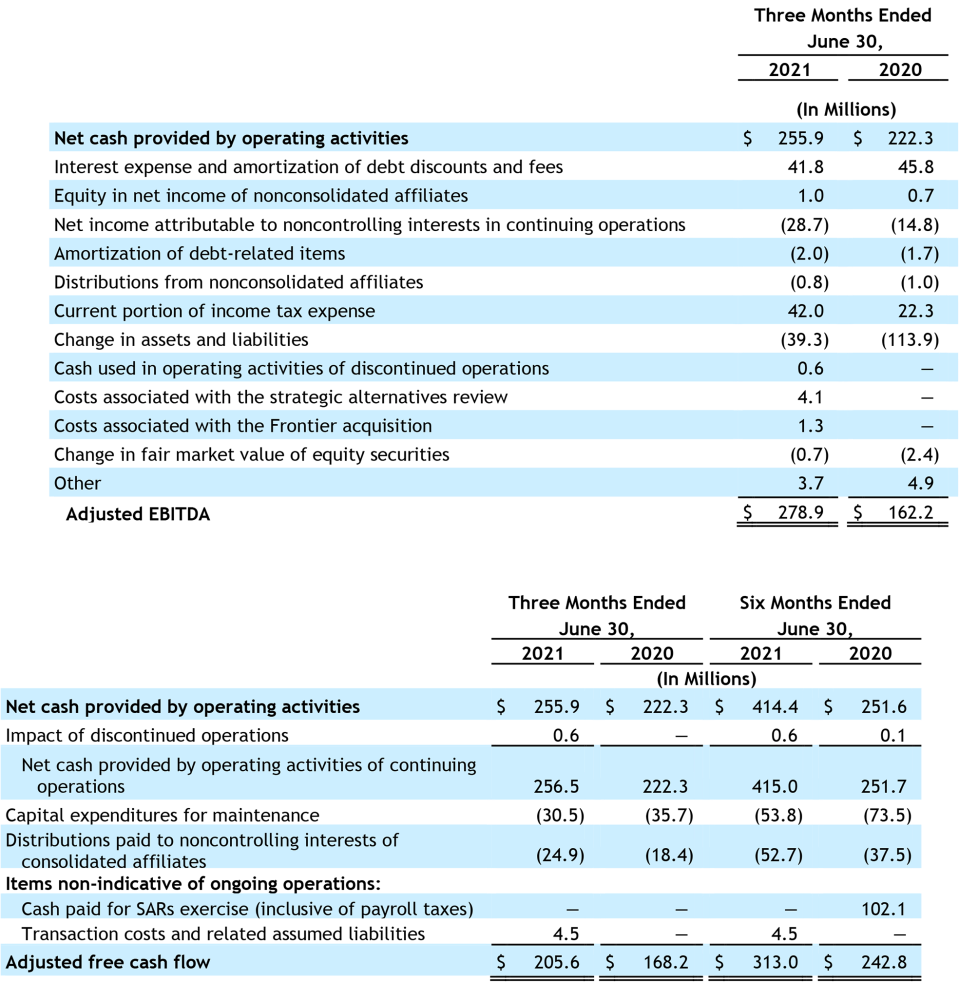

Additional Key Financial Information

The financial data contained in this Blog post include the non-GAAP financial measures: Adjusted Earnings per Share, Adjusted EBITDA, and Adjusted Free Cash Flow. The most comparable GAAP measure for Adjusted Earnings per Share is Income from continuing operations attributable to Encompass Health per diluted share, which increased 232.4% for the second quarter ended June 30, 2021 compared to the same period in 2020. The most comparable GAAP measure for both Adjusted EBITDA and Adjusted Free Cash Flow is Cash flows provided by operating activities, which increased 15.1% for the second quarter ended June 30, 2021 compared to the same period in 2020. The following are reconciliations of each of these non-GAAP measures to its most comparable GAAP measure.

For the three months ended June 30, 2021, net cash used in investing activities was $226.0 million and primarily resulted from capital expenditures and the acquisition of assets from Frontier Home Health and Hospice. Net cash used in financing activities during the three months ended June 30, 2021 was $186.4 million and primarily resulted from net debt payments, cash dividends paid on common stock, and distributions to noncontrolling interests of consolidated affiliates.

For the three months ended June 30, 2020, net cash used in investing activities was $92.1 million and primarily resulted from capital expenditures. Net cash provided by financing activities during the three months ended June 30, 2020 was $182.8 million and primarily resulted from the issuance of additional senior notes in May 2020 offset by cash dividends paid on common stock and distributions paid to noncontrolling interests of consolidated affiliates.

For the six months ended June 30, 2021, net cash used in investing activities was $321.6 million and primarily resulted from capital expenditures and the acquisition of assets from Frontier Home Health and Hospice. Net cash used in financing activities during the six months ended June 30, 2021 was $263.9 million and primarily resulted from net debt payments, cash dividends paid on common stock and distributions to noncontrolling interests of consolidated affiliates.

For the six months ended June 30, 2020, net cash used in investing activities was $175.1 million and primarily resulted from capital expenditures. Net cash provided by financing activities during the six months ended June 30, 2020 was $253.9 million and primarily resulted from the issuance of additional senior notes in May 2020 offset by the settlement of the final put and exercise of the Home Health Holdings rollover shares and SARs, cash dividends paid on common stock, and distributions paid to noncontrolling interests of consolidated affiliates.

Excluding net operating revenues, the Company does not provide guidance on a GAAP basis because it is unable to predict, with reasonable certainty, the future impact of items that are deemed to be outside the control of the Company or otherwise non-indicative of its ongoing operating performance. Such items include government, class action, and related settlements; professional fees—accounting, tax, and legal; mark-to-market adjustments for stock appreciation rights; gains or losses related to hedging instruments; loss on early extinguishment of debt; adjustments to its income tax provision (such as valuation allowance adjustments and settlements of income tax claims); items related to corporate and facility restructurings; and certain other items the Company believes to be non-indicative of its ongoing operations. These items cannot be reasonably predicted and will depend on several factors, including industry and market conditions, and could be material to the Company’s results computed in accordance with GAAP.

However, the following reasonably estimable GAAP measures for 2021 would be included in a reconciliation for Adjusted EBITDA if the other reconciling GAAP measures could be reasonably predicted:

- Interest expense and amortization of debt discounts and fees – estimate of $164 million to $174 million

- Amortization of debt-related items – approximately $9 million

The content of this site is for informational purposes only and should not be taken as professional medical advice. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding any medical conditions or treatments.